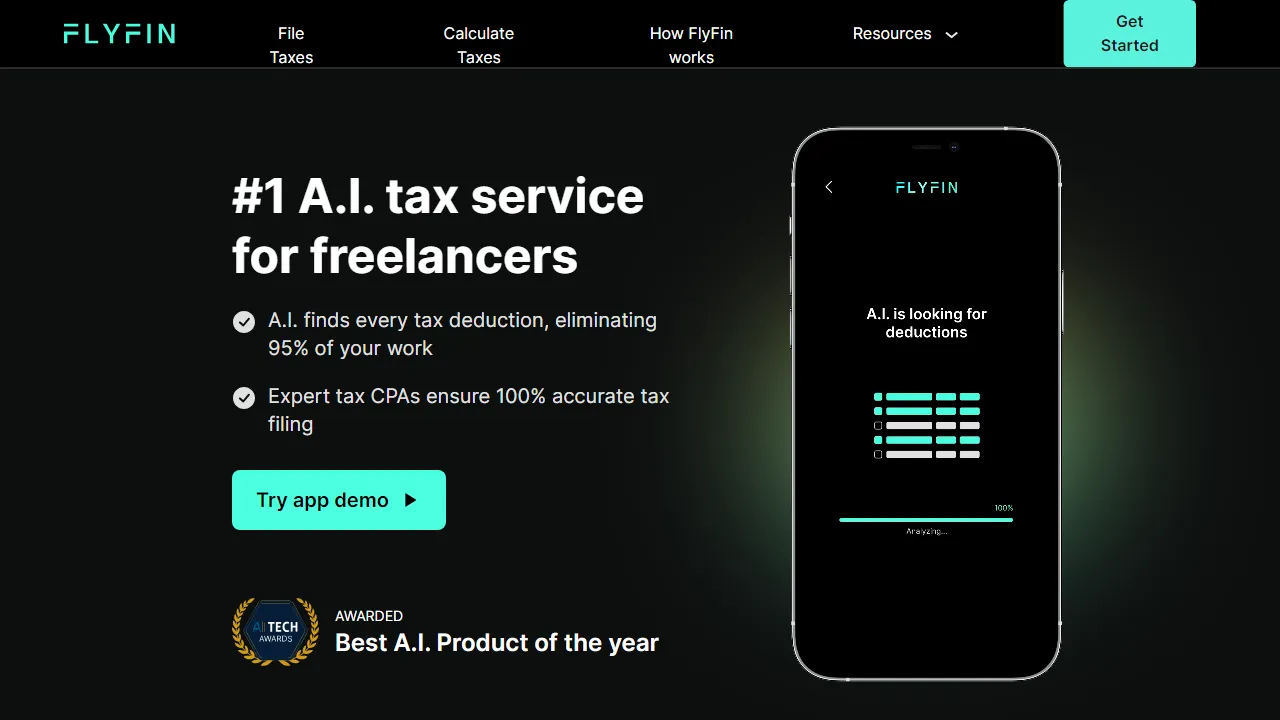

Main Purpose

FlyFin is an AI-powered tax service designed to assist self-employed individuals, freelancers, and independent contractors in filing their taxes accurately and efficiently.

Key Features

- AI-Powered Expense Tracking: FlyFin's AI technology automatically scans and categorizes business expenses, ensuring that all deductible expenses are captured.

- Tax Deduction Optimization: The AI system identifies potential tax deductions, helping users maximize their tax savings.

- CPA Support: FlyFin provides access to a team of certified public accountants (CPAs) who can answer tax-related questions and provide personalized assistance.

- Secure Document Upload: Users can securely upload necessary tax documents for e-filing, ensuring a smooth and efficient tax preparation process.

- E-Filing: FlyFin supports electronic filing of tax returns, eliminating the need for paper forms and reducing the risk of errors.

Use Case

- Self-Employed Individuals: FlyFin is particularly useful for self-employed individuals who need assistance in tracking business expenses, optimizing tax deductions, and filing their taxes accurately.

- Freelancers and Independent Contractors: FlyFin simplifies the tax filing process for freelancers and independent contractors by automating expense tracking and providing access to expert CPAs.